21st Century Financial Solutions

At Abundant Financial, our Proactive Planning Team provides proactive planning, holistic solutions, and a collaborative approach to help you achieve financial abundance.

Team-Based Approach

We combine the expertise of specialized professionals to create comprehensive financial solutions.

Proactive Planning

We anticipate your needs and prepare for life transitions before they occur.

Holistic Solutions

Our integrated approach addresses all aspects of your financial life for optimal results.

Our Financial Services

Comprehensive solutions tailored to your unique financial goals and circumstances.

Comprehensive Financial Planning

A holistic approach to financial planning that considers all aspects of your financial life.

> Team-based approach with coordinated experts.

> Proactive planning for life transitions

> Regular progress reviews and adjustments

Wealth Management

Our team-based wealth management approach integrates investment strategies with your broader financial plan for optimal out comes.

> Holistic portfolio construction

> Tax efficient investing strategies

> Ongoing professional monitoring

Retirement Income Planning

Develop a sustainable retirement income strategy that addresses your unique needs and goals through our team's collaborative expertise.

> Customized income distribution strategies

> Proactive Social Security optimization

> Healthcare cost planning

Life Insurance & Risk Mitigation

Protect your family wealth and business with comprehensive risk management strategies and tailored insurance solutions that provide peace of mind and serve your overall financial goals.

> Life Insurance Solutions

> Income Protection Strategies

> Long-Term Care Options

> Estate Liquidity Planning

Integrated Tax Planning

Coordinate yourinvestment, retirement, and estate strateigies with tax planning throuugh our collaborative team of professionals.

> Proactive tax-loss harvesting

> Strategic Roth conversion planning

> Charitable giving strategies

Estate & Legacy Planning

Preserve your wealth and ensure your assets are transferred according to your wishes through our holistic legacy planning process.

> Coordinated estate document preparation

> Family wealth transfer strategies

> Charitable legacy planning.

Business Owner Solutions

Specialized planning for entrepreneurs and business owners, addressing the unique challenges of business and personal financial integration.

> Business succession planning

> Executive compensation strategies

> Retirement plan optimization

Commercial Private Lending

Fast, flexible commercial lending solutions tailored to investors, developers, and small business owners. Our private lending solutions offer speed, simplicity, and reliability.

> Fix-and- Flip Loans

> Bridge Financing

> Commercial Property Loans

> Business Expansion Capital

Merger & Acquisition (M&A) Services

Unlock growth through strategic business transitions. Our M&A service helps business owners, investors and entrepreneurs buy, sell, or merge companies with confidence.

> Strategic planning and advisory

> Business valuation and financial analysis

> Deal sourcing and buyer/seller matching

> Due diligence coordination

> Contract structuring and closing support

About Abundant

Our Proactive Planning Team of specialized professionals collaborates to deliver comprehensive, proactive, and holistic financial solutions.

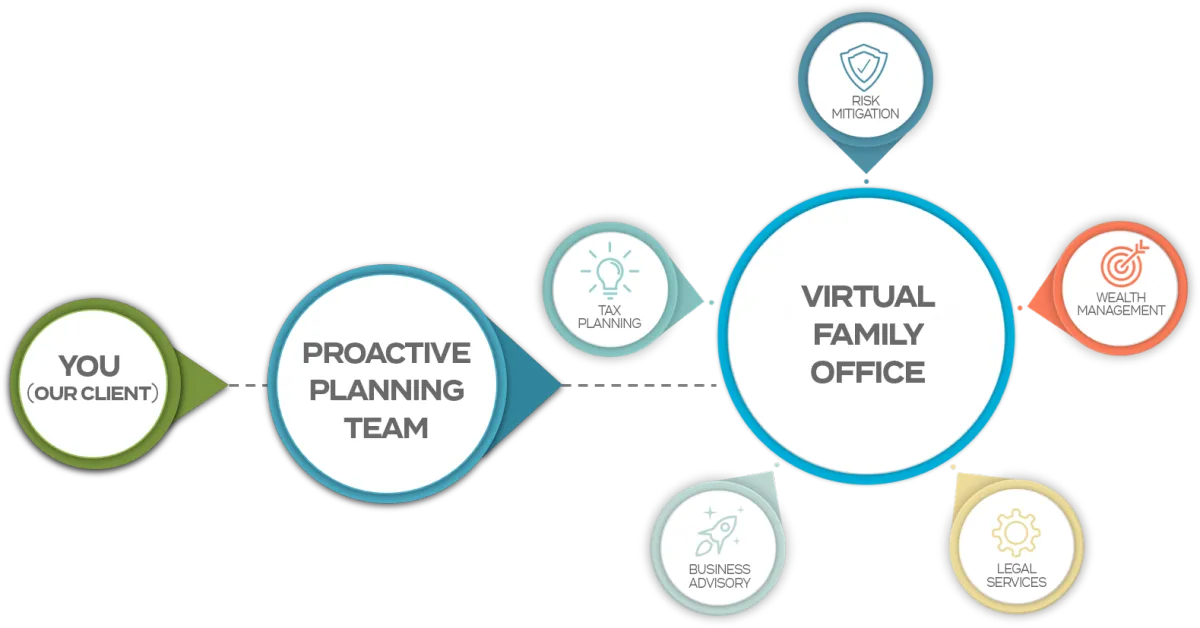

Our Approach

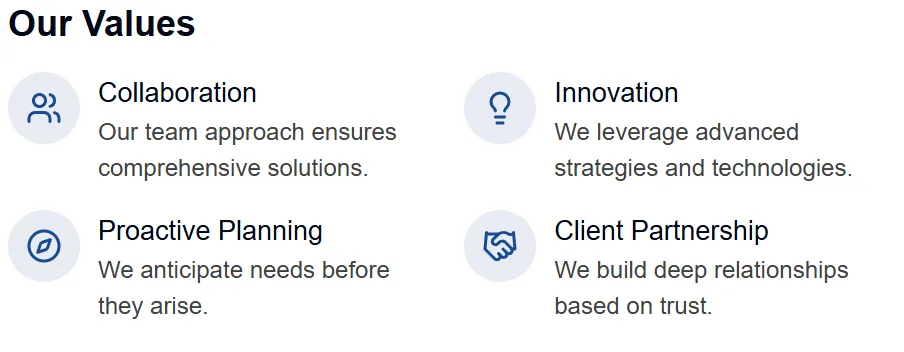

At Abundant, we believe that a team-based approach to financial planning provides superior results. Our Proactive Planning Team brings together specialized expertise across multiple disciplines to deliver integrated solutions tailored to your unique situation.

Virtual Family Office

Our Virtual Family Office model gives you access to more than 75 national experts who are the best in their fields. This elite network collaborates to create tailored strategies that are optimized for your specific situation. All coordination is handled by your dedicated Planning Team Lead, serving as your single point of contact.

Business Owner Solutions

75+ National Experts

Our Virtual Family Office connects you with best-in-class professionals across multiple disciplines, all coordinated seamlessly by your dedicated Planning Team Lead.

Client Success Stories

Hear what our clients have to say about their experience with Abundant Financial Services.

Working with Abundant Financial Services transformed our retirement planning. Their personalized approach and clear guidance gave us confidence that we're on the right track for a secure future.

JR

Client since 2018

I appreciate how the team at Abundant Financial Services takes the time to understand my goals and risk tolerance. Their investment strategies have consistently outperformed my expectations.

RL

Client since 2019

As a small business owner, I needed specialized financial guidance. The advisors at Abundant Financial Services created a comprehensive plan that addressed both my business and personal financial goals.

MC

Client since 2020

Frequently Asked Questions

Find answers to common questions about our financial services.

What is the minimum investment required to work with your firm?

We work with clients at various stages of their financial journey. While our comprehensive wealth management services typically start at $250,000 in investable assets, we offer financial planning services with lower minimums. We're happy to discuss your specific situation during a complimentary consultation.

How do you determine the right investment strategy for me?

We begin with a comprehensive assessment of your financial situation, goals, time horizon and risk tolerance. This process includes a detailed discussion and questionnaires to understand your comfort level with different investment approaches. Based on this information, we develop a personalized investment strategy that aligns with your specific needs and objectives.

What fees do you charge for your services?

Our fee structure depends on the specific services you require. For investment management, we typically charge a percentage of assets under management, which decreases as your portfolio grows. Financial planning services may be offered on a flat-fee or hourly basis. We believe in complete transparency and will clearly outline all fees before you make any decisions.

How often will we review my financial plan?

We recommend comprehensive reviews at least annually, but we monitor your investments continuously. Additionally, we schedule reviews whenever significant life events occur (marriage, birth of a child, career change, approaching retirement, etc.) or when there are major economic or market changes that may impact your strategy. Our goal is to ensure your financial plan evolves with your life.

What makes Abundant Financial Services different from other financial advisors?

What distinguishes us is our personalized approach and fiduciary commitment to putting your interests first. Our advisors are highly credentialed and experienced in specialized areas of finance. We take time to truly understand your goals and develop customized strategies rather than offering one-size-fits-all solutions. Additionally, we provide ongoing education and support to help you make informed financial decisions throughout your journey.

Don't see your question? Contact us directly

Ready to Secure Your Financial Future?

Schedule a complimentary consultation with one of our expert financial advisors to discuss your goals and begin your journey towards financial security.

Your trusted partner in financial growth and investment success, committed to securing your financial future.

Quick Links

Home

About Us

Services

Useful Links

Testimonials

FAQs

Blog